Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SOL shrank 9% in the last 24 hours.

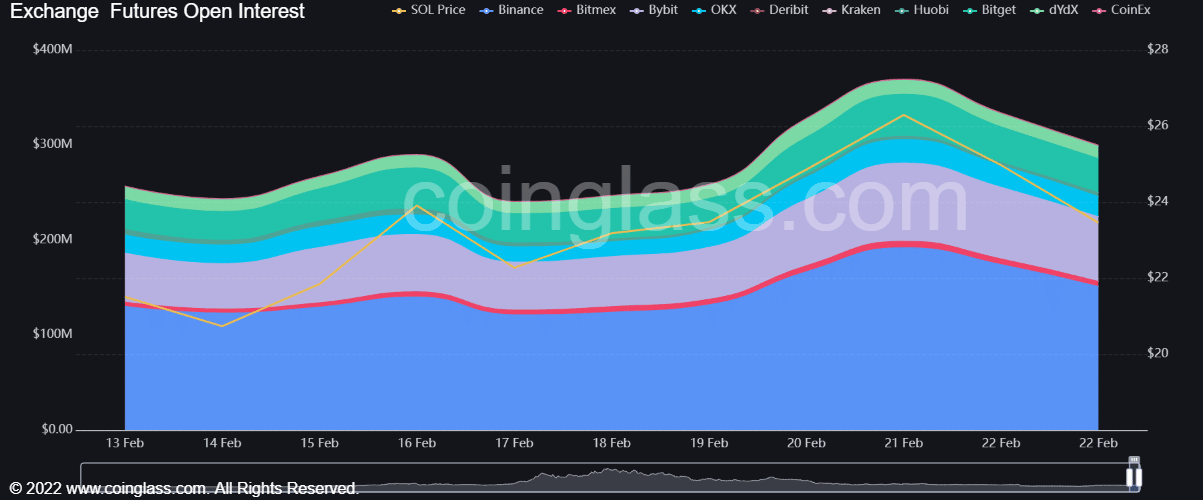

- Falling open interest rates and stock market rout could prolong the downtrend.

Solana’s [SOL] market structure could continue to benefit the bears from a macroeconomic perspective. Macroeconomic uncertainty is increasing as Fed watchers worry that its aggressive rate hikes to tackle stubborn inflation will continue for longer.

Read Solana’s [SOL] Price Prediction 2023-24

The recent momentum in equity markets has slowed as most indexes closed in the red on Tuesday. Bitcoin [BTC] also failed to maintain the $25,000 level again and was trading at $23.97k at press time, sending the altcoin market into retracement.

SOL reaches 50% Fib level – Can the bears prevail?

Source: SOL/USDT on TradingView

So far, SOL has struggled to break above the $27 hurdle – a major selling pressure even in the three-hour time frame. The recent rejection of the price at this level has seen SOL fall 9% and retest the 50% Fib level at press time.

Given the market rout, the bears could benefit more if the 50% Fib level is broken. So, they could target the 38.2% Fib level at $22.53 or the 23.6% Fib level at $21.44. However, an extreme dowsing could drive SOL towards $17 or $15.

Bulls could target overhead resistance at $27 if the market rallies, especially if BTC hits $25k again and the 50% Fib level proves stable. Bulls should take hold if the 50% Fib level is not breached.

The RSI was at 50, indicating a neutral structure that could move in either direction. Investors should therefore monitor the price performance of BTC.

How much are 1,10,100 SOLs worth today?

SOL’s open interest (OI) declined

Source: Coinglass

SOL’s OI peaked on 21 February before declining thereafter, highlighting the prevailing bearish sentiment. If the OI continues to fall after SOL closes below $23, the extremely bearish sentiment could undermine the bulls’ chance of a rally at the 50% Fib level. Such a move would provide the bears with further opportunities.

Moreover, according to Coinanalyze, over $2.5 million worth of long positions have been liquidated in the last 24 hours, adding to the bearish sentiment and leverage for short sellers.

This news is republished from another source.