Well-known crypto analyst TechDev says that Bitcoin (BTC) is probably in the midst of a bear trap to shake out weak hands before a large move up in price.

The pseudonymous analyst shares with his 464,000 followers on the social media platform X a Bitcoin chart that suggests BTC is mirroring its 2017 pre-parabola price action after roughly 1,200 days of accumulation.

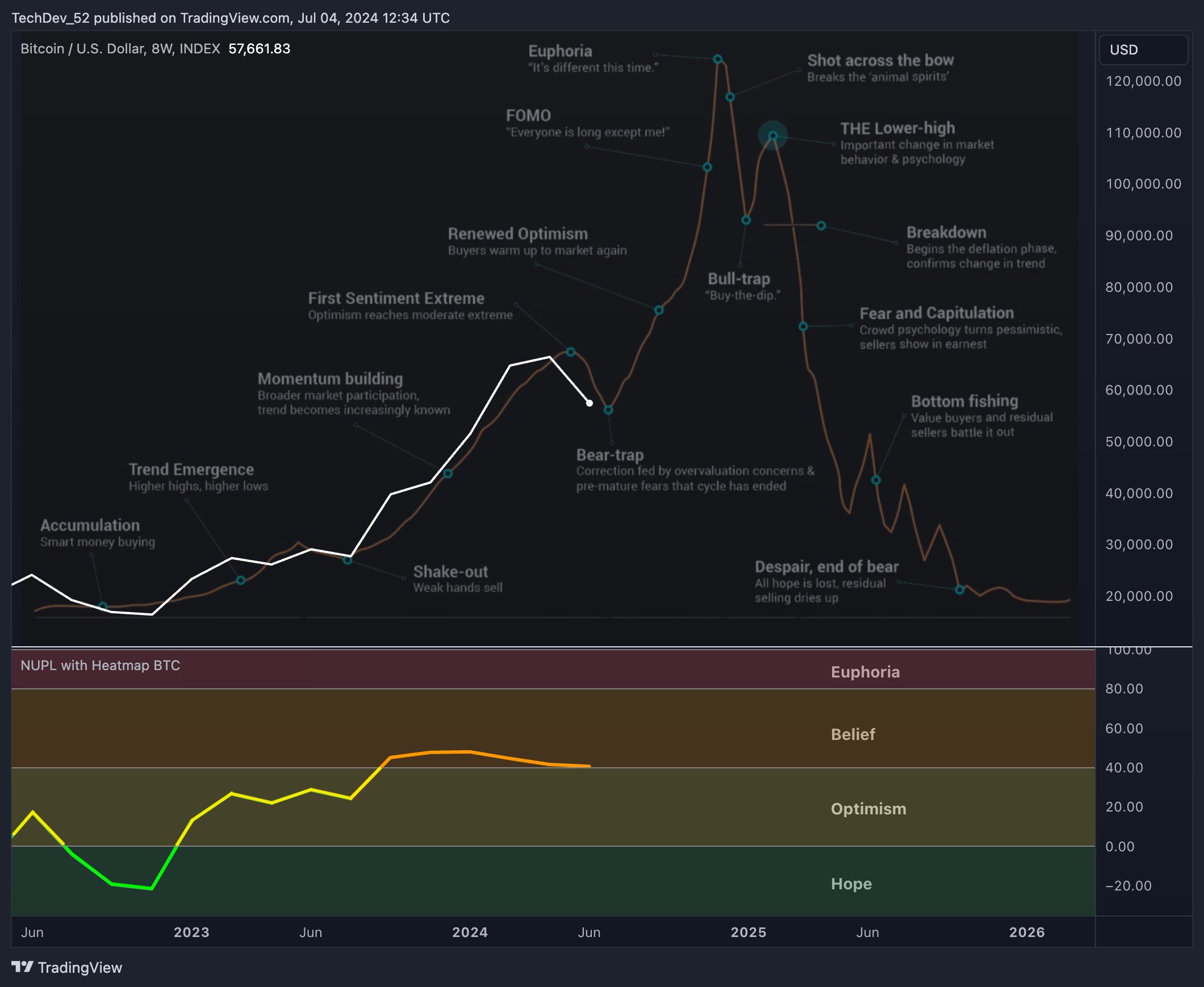

TechDev’s chart also incorporates the net unrealized profit and loss (NUPL) metric, which gauges the overall sentiment of market participants by tracking the unrealized gains and losses of all coins in circulation.

Based on his chart, the analyst sees Bitcoin’s NUPL going through four different stages in a bull cycle: hope, optimism, belief and euphoria. The analyst suggests that Bitcoin is in the belief stage where the biggest rallies of the bull run happen.

“Bitcoin.”

TechDev shares another chart showing what he thinks are the 16 different stages of the Bitcoin market cycle.

He believes that BTC is currently in the “bear trap” phase where a “correction fed by overvaluation concerns and pre-mature fears that the cycle has ended” brings prices down, just before a massive expansion into the euphoria zone.

TechDev also takes a look at two indicators that he says have a good track record at calling the beginning and end of previous Bitcoin blow-off tops: the relative strength index (RSI) and the Chaiken Money Flow (CMF) index. The RSI is a momentum indicator while the CMF is a volume-weighted average of accumulation and distribution over a given period.

Says TechDev,

“RSI calls the tops. CMF calls the blow-offs.”

Looking at the trader’s chart, he seems to suggest that the RSI has yet to hit a descending resistance line that signaled the end of bull markets in previous cycles. Meanwhile, the CMF has just broken above a resistance level that has previously signaled the start of big Bitcoin rallies.

At time of writing, Bitcoin is trading for $55,282.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

This news is republished from another source.