Following the Terra blockchain fallout and the great UST de-pegging event, the Terra network ecosystem is now a wasteland of almost worthless tokens and protocols. While both UST and LUNA were top ten crypto market cap contenders, Terra’s decentralized finance (defi) presence was second to Ethereum in terms of total value locked. Today, the remaining Terra-based token holders and defi protocol operators seem to be waiting for a miracle.

Terra’s Token Economy Has Lost 96% of Its Value

There’s been an abundance of news surrounding the Terra blockchain fiasco and how the team handled the terrausd (UST) implosion. A lot of people know that UST and Terra’s native token LUNA have lost considerable value over the last two weeks. UST has had a 24-hour price range between $0.068 to $0.054 per unit, which is a lot less than the $1 parity it held before the fallout.

LUNA too is down a great deal as it was trading for $72 per coin on May 7, and is now down 99.999849% at $0.00010853 per LUNA. But Terra also had a whole ecosystem of tokens like ANC, MIR, ASTRO, MARS, and more.

Anchor (ANC) the governance token for the defi protocol is down 96% over the past two weeks, and Astroport’s ASTRO token is down 98%. Mirror Protocol’s MIR lost 80.4% while Pylon Protocol’s MINE has shed 96.9% in the last 14 days.

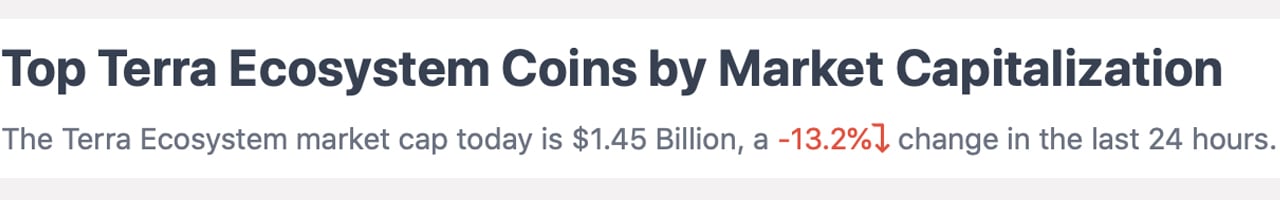

Similarly, Mars Protocol (MARS) has lost 97.6% and the Loop Finance token LOOP is down 98.3% over the past two weeks. Statistics show on March 7, 2022, the Terra ecosystem of tokens was worth $44 billion and today its down 96.70% to $1.45 billion.

From the 2nd Largest in Defi to the 33rd — Terra’s Defi Presence Has Been Eradicated

Terra’s presence in decentralized finance was once very large as it held the second-largest total value locked (TVL) out of all the blockchains in existence. On April 5, 2022, Terra’s TVL in defi was $31.21 billion and today, it’s down to $118.81 million.

Every single Terra defi protocol has suffered from 90-99% losses in terms of TVL per protocol. The applications are ghost towns and block explorers like finder.terra.money show extremely low activity for every Terra defi protocol.

The same can be said for applications like Terra Name Service (TNS) and non-fungible token (NFT) marketplaces like Random Earth, Knowhere, Talis, Luart, Curio, and One Planet. While name service domains on TNS were once $16 per name, they now cost $0.91 to register a name.

As far as NFT marketplaces built on Terra, some markets are still selling NFTs that were once quite expensive, but now the tokens are selling for bottom-of-the-barrel prices. Some NFT collectors removed their listings and are possibly waiting for a Terra re-birth. Most Terra NFT marketplaces are ghost towns in terms of activity.

The Hope for Terra’s Rebirth

A revival is likely the hope for many Terra community members, as the project’s founder Do Kwon and many other Terra supporters have put forth a revival plan to resurrect Terra from the ashes. The plan is to fork the chain at a snapshot before the UST de-pegging event and airdrop new tokens to UST and LUNA holders.

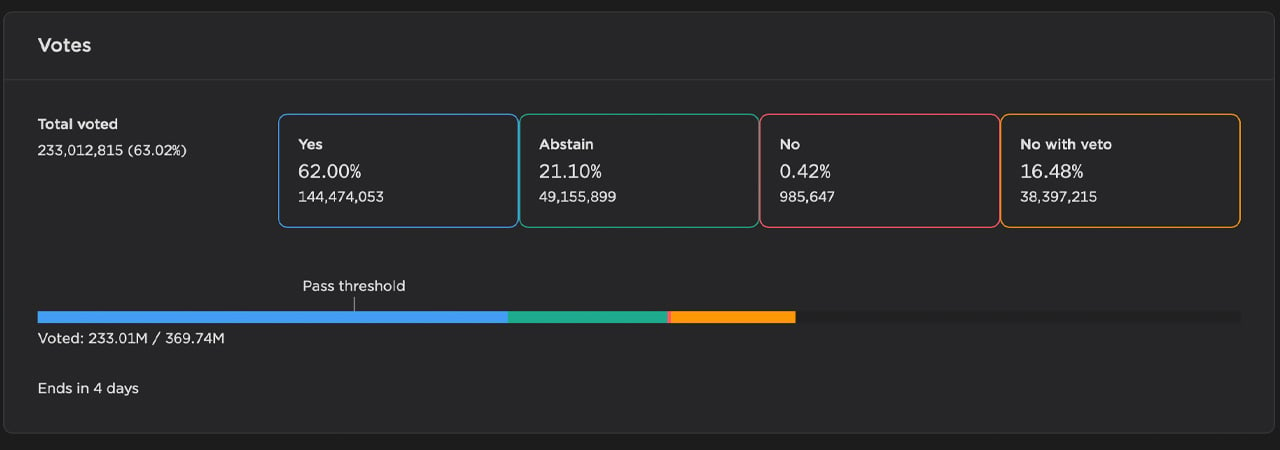

Presently, the rebirth proposal vote has four more days but the number of “yes” votes has passed the threshold at 62%. 21.10% have abstained from voting, 0.42% have voted “no,” and 16.48% voted “no with veto.”

What do you think about what’s left of the Terra blockchain ecosystem? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

This news is republished from another source.