- Konami and Avalanche collaborate to launch ‘’Resella’’ NFT platform.

- Metric suggest a potential price surge.

Gaming giant Konami, creator of Metal Gear Solid, has partnered with Avalanche [AVAX] to develop a new NFT platform called “Resella.” This collaboration marks Konami’s entry into blockchain and could spark the Avalanche adoption ecosystem.

Crypto analyst, Dan Johnson, tweeted that AVAX will expand after price consolidation. Konami’s massive user base could drive significant attention and new users to Avalanche’s network.

AVAX remains muted despite news

Despite the bullish news, AVAX has stagnated in the short term. At press time, AVAX was trading at $27.76, down 1.1% in the last 24 hours.

The asset has broke down the support level at $29.22 on june 24 before retracing to the current levels. This suggest that the market is at a ‘’wait and see’’ point while investor are assessing the implications of Konami partnership.

Source: TradingView

Mixed signals from the on chain metrics

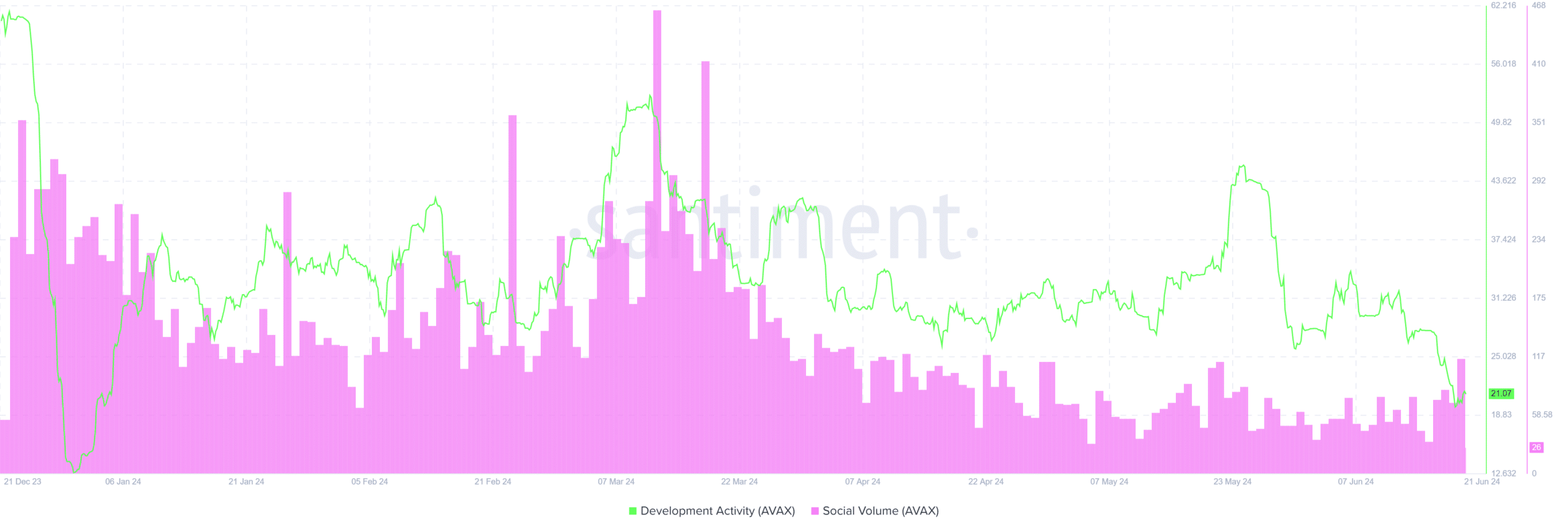

To assess the analyst prediction, AMBCrypto analysed the sentiments, social volume and development activity data.

The social volume data indicated significant fluctuations, with recent spikes likely tied to the announced Konami partnership. This may suggest higher market volatility in the short term.

The development activities indicated several spikes in recent days. Today’s dinstint spike could be tied to the Konami announcement. This is a bullish market sentiment in the long run.

Source: Santiment

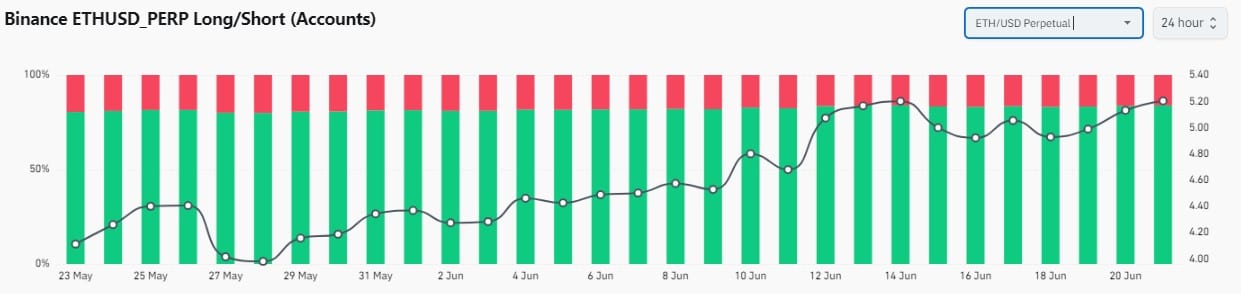

Bulls versus bears

We further analysed the long/short ratio Coinglass data. According to the data, the long/short ratio for Avalanche indicated 83.33% long positions against 16.12% short positions.

This suggests that the bulls are in control of the market. This could be positively correlated with the Konami announcement-anticipation for a possible AVAX price surge continuation.

Source: Coinglass

Read Avalanche’s [AVAX] Price Prediction 2024-25

What next for AVAX?

The analyzed market sentiment all signals a bullish rally, marrying with the analyst’s breakout potential phase. AVAX may surge to the $29.22 resistance zone and potentially break free to target at the $39.46 level.

However, if the bullish momentum is not enough, the price could retrace the resistance zone and dip further.

This news is republished from another source.